Maximizing Returns: Proven Strategies for Tax-Efficient Investing

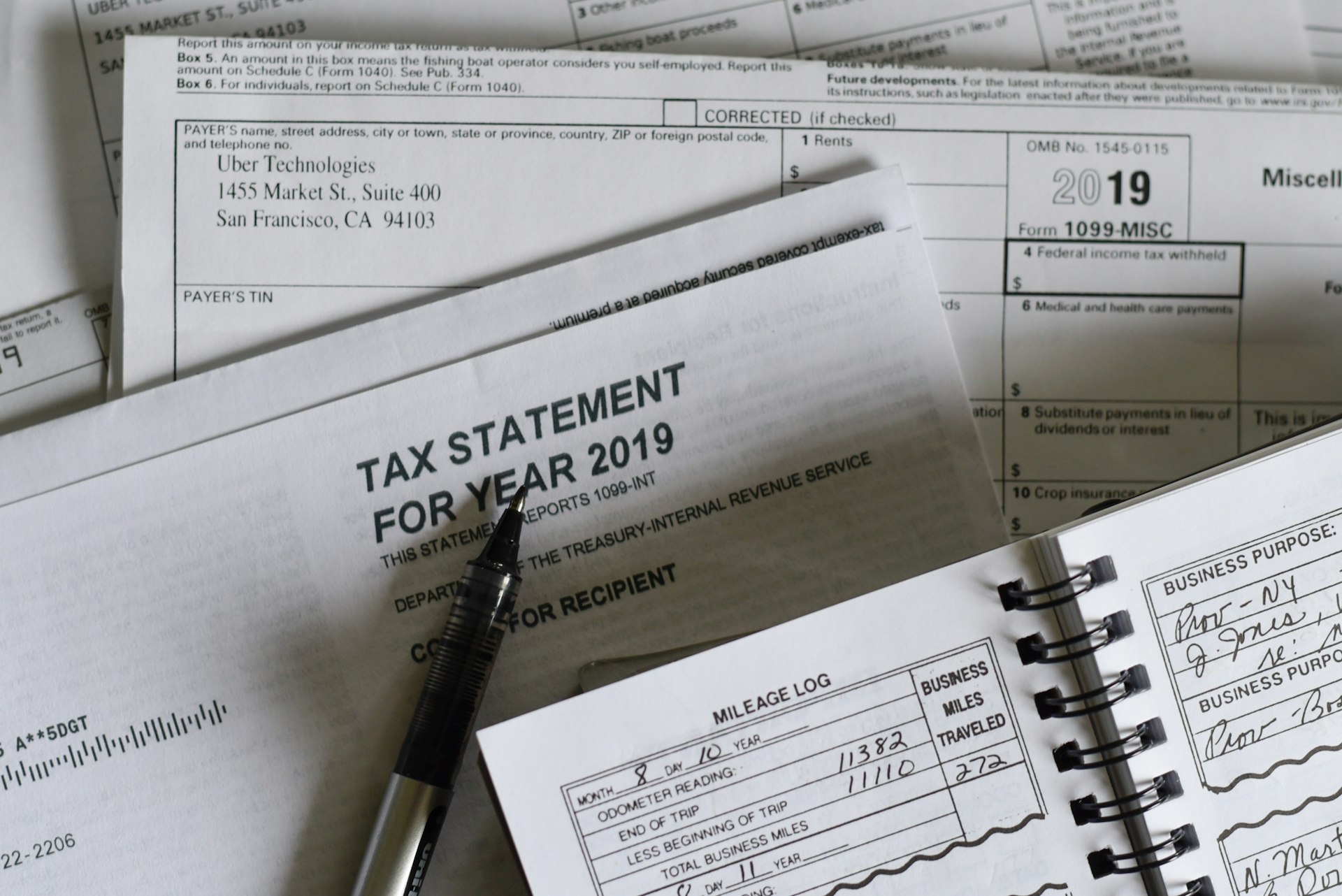

Photo by Olga DeLawrence on Unsplash

Introduction: Why Tax-Efficient Investing Matters

When building wealth, the impact of taxes on investment returns is often underestimated. Yet, every dollar saved from taxes can be reinvested, compounding your wealth over time. Tax-efficient investment strategies are essential for investors who want to minimize the drag of taxes and maximize their net returns. This guide explores accessible, actionable methods to make your investments more tax-efficient, with practical steps and real-world examples.

Understanding Account Types and Their Tax Implications

To establish a tax-efficient strategy, start by understanding the three primary types of investment accounts:

Taxable accounts (such as brokerage accounts) are flexible and allow unrestricted investing, but offer no special tax breaks. Investment income-like dividends, interest, and realized capital gains-is taxable in the year it is received or realized. There are no contribution limits, and you can withdraw at any time, but taxes will reduce your overall returns. [4]

Tax-deferred accounts (e.g., 401(k), traditional IRA, SEP IRA) let your investments grow without yearly tax liability. You can often deduct contributions, lowering your taxable income in the year of the contribution. Taxes are only owed when you withdraw funds, typically during retirement. Contribution limits and withdrawal rules apply. [4]

Tax-exempt accounts (Roth IRA, Roth 401(k)) require after-tax contributions, but all future growth and qualified withdrawals are tax-free. While these accounts have income and contribution limits, they offer significant advantages for long-term, tax-free growth. [4]

Key takeaway:

The way you allocate investments across account types-also called asset location-can have a major impact on your after-tax returns.

Asset Location: Placing the Right Investments in the Right Accounts

Asset location is a foundational tax-efficient strategy. The concept involves placing investments in accounts where their tax characteristics are most favorable:

Tax-efficient assets -such as index funds, exchange-traded funds (ETFs), and municipal bonds-are best held in taxable accounts. These investments typically generate long-term capital gains and qualified dividends, which are taxed at lower rates than ordinary income. [1] [2]

Tax-inefficient assets -like actively managed mutual funds with high turnover, taxable bonds, and alternative investments producing ordinary income-should be allocated to tax-deferred or tax-exempt accounts. This shields income from immediate taxation, allowing it to compound. [1] [5]

Implementation steps:

- Review your current account types (brokerage, IRA, 401(k), Roth, etc.).

- Classify each holding as tax-efficient or tax-inefficient based on income type and turnover.

- Shift high-turnover and income-generating assets to tax-advantaged accounts as allowed.

- Maintain your overall asset allocation and risk profile during this process.

Example:

Suppose you own both municipal bonds and corporate bonds. Municipal bonds, whose interest is often federally tax-free, belong in your taxable account. Corporate bonds, which pay taxable interest, are more tax-efficient in an IRA or 401(k).

[1]

Choosing Tax-Efficient Investments

Some investments are inherently more tax-efficient than others. Here’s how you can make smarter choices:

Index funds and ETFs: These funds typically have low turnover, generating fewer taxable events. ETFs, in particular, use a unique in-kind redemption process that can further reduce capital gains distributions. [2] [3]

Municipal bonds: Interest income from municipal bonds is generally exempt from federal taxes and may also be exempt from state and local taxes, especially if you invest in bonds issued by your state of residence. These can be particularly attractive for investors in higher tax brackets. [5]

Tax-managed mutual funds: These funds use strategies such as minimizing turnover and harvesting losses to reduce the amount of taxable income distributed to shareholders.

Implementation steps:

- When investing in taxable accounts, prioritize index funds, ETFs, and municipal bonds.

- Ask your financial advisor or brokerage to provide a list of tax-managed fund options.

- Regularly review your holdings for tax efficiency, especially after significant life events or tax law changes.

Example:

An investor in a high tax bracket might choose a municipal bond fund for their taxable account rather than a corporate bond fund, resulting in significant tax savings on interest income.

[3]

Tax-Loss Harvesting: Turning Losses into Opportunities

Tax-loss harvesting is the practice of selling investments at a loss to offset realized gains elsewhere in your portfolio. By strategically realizing losses, you can reduce your taxable capital gains for the year, and potentially carry unused losses forward to future years. [2]

How to implement tax-loss harvesting:

- Periodically review your portfolio for underperforming investments with unrealized losses.

- Sell assets at a loss to offset realized gains from other sales during the tax year.

- Avoid the wash-sale rule by not purchasing the same or a “substantially identical” security within 30 days before or after the sale.

- Consult a tax professional or use tax software to ensure compliance and optimal results.

Example:

In a volatile year, you sell a stock that’s down $3,000 from your purchase price. If you have $3,000 in realized gains from another investment, your net capital gain for tax purposes is zero.

Maximizing Contributions to Tax-Advantaged Accounts

One of the simplest and most effective ways to minimize investment taxes is to maximize your contributions to tax-advantaged accounts. These include employer-sponsored plans (401(k), 403(b)), IRAs, Roth IRAs, and Health Savings Accounts (HSAs). [4]

Implementation steps:

- Contribute as much as you can up to annual limits set by the IRS for each account type.

- If your employer offers a matching contribution for a 401(k) or similar plan, aim to contribute at least enough to receive the full match.

- Use Roth accounts for assets you expect to appreciate significantly, as all qualified withdrawals will be tax-free.

- Consider HSAs for qualified medical expenses; these accounts offer triple tax benefits (contributions are tax-deductible, investment growth is tax-free, and withdrawals for qualified expenses are tax-free).

Example:

If you contribute $7,000 to a traditional IRA and are eligible for a full deduction, you can lower your taxable income by $7,000 for the year, deferring taxes until withdrawal.

[4]

Charitable Giving as a Tax-Efficient Strategy

Charitable giving can reduce your taxable income, especially if you itemize deductions. Donating appreciated assets-such as stocks held for more than a year-can be particularly tax-efficient: you avoid paying capital gains tax on the appreciation and receive a deduction for the asset’s fair market value. [2]

Implementation steps:

- Identify appreciated securities in your portfolio held for more than one year.

- Donate these assets directly to a qualified charity, rather than selling them first.

- Ensure proper documentation and confirm the charity’s eligibility with the IRS.

- Consult your tax advisor to determine the deduction limits and reporting requirements.

Alternative:

If you aren’t itemizing deductions, consider qualified charitable distributions (QCDs) from IRAs if you are age 70½ or older.

Practical Steps for Getting Started and Accessing Resources

If you’re ready to make your portfolio more tax-efficient:

Photo by Precondo CA on Unsplash

- Gather account statements and review current holdings.

- Classify your investments and accounts as described above.

- Consult with a tax professional or a Certified Financial Plannerâ„¢ for personalized advice.

- For more information on specific strategies, visit reputable financial firms’ educational resources such as Vanguard, Charles Schwab, Fidelity, or Morgan Stanley. You can search their official websites for “tax-efficient investing” to access timely guides and tools.

You can also contact your investment provider’s customer support line or local branch for assistance. If you’re looking for a qualified advisor, consider searching the CFP Board’s official website for a list of credentialed professionals in your area.

Key Takeaways and Ongoing Oversight

Tax-efficient investing is not a one-time event; it requires ongoing monitoring and adjustment. Tax laws change, as do personal circumstances and investment goals. By regularly reviewing your asset location, investment choices, and account contributions, you can keep more of your gains working for you. Remember, professional advice can help you optimize strategies for your specific situation and avoid costly mistakes.

References

- [1] Mariner Wealth Advisors (2023). Three Strategies for Tax-Efficient Investing.

- [2] Vanguard (2023). Effective tax-saving strategies for investors.

- [3] Edward Jones (2023). Tax-efficient investing for high-income earners.

- [4] SoFi (2023). Tax-Efficient Investing: Strategies for Beginners.

- [5] Morgan Stanley (2023). Tax-Efficient Investing: Helping Keep Returns.